- +91 9357253596

-

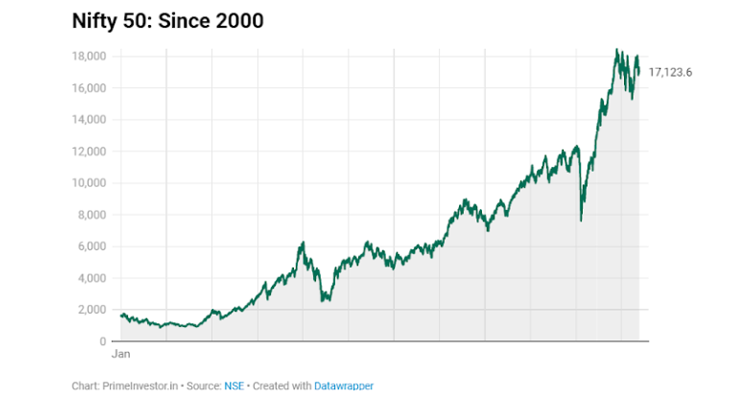

In the past two years, markets have witnessed a total roller-coaster ride and are continuing to do so. And with this our investments have also suffered a lot, especially equity-linked investments. But, in this panic-driven situation, everyone gets anxious about whether they should continue investing, or should wait for things to get settled.

So, to assist you in making this decision here is a guide for you.

First and foremost thing is that never stop your SIPs during a market fall, now you may ask why, so here is the answer.

The common tendency that people have is that they invest only when the markets are in a bull run, and stock prices have reached their highs. But, true fortunes are always made when you invest in stocks when they are undervalued. Short-time market volatility should not be a reason for you to withdraw your investment or stop your SIP, which is for your long-term goals.

SIPs should be continued irrespective of the market movement because if you continue investing then your average cost of purchase will be decreased, i.e., the downfall of the market will result in lower Net Asset Value (NAV), which simply translates into buying more units for the same price, whose value will increase in the future.

Suppose person A and person B invest ₹10,000 each, every month starting from January, now due to the market fall, the value of the investment falls to ₹8,000.

Now, person A turns anxious to see his investment value fall, and decides to withdraw the investment, and bears a loss of ₹2,000. Whereas person B continues the investment through SIP, and in April the market recovers and the investment of ₹30,000 grows to ₹36,000. And, because of this, he manages to make a profit of ₹6,000. And, this is possible because, in the long run, the markets have always been profitable.

You need to understand that it is completely natural to get anxious while witnessing a decrease in your portfolio value, but the one who continues even after this, witnesses the magic power of compounding.

Compounding? What’s that?

Let’s understand this with an example, Person A invests ₹5,000 every month through a SIP, and suppose his investment grows and becomes, ₹5500 the very next month of starting the SIP, and this profit of ₹500 will be reinvested and this will help in the tremendous growth of the investment.

So, in simpler words, compounding is the effect of reinvesting. And if you want to witness the power of this effect, stopping SIPs during a market downturn would be the worst mistake you could make.

As Warren Buffet once said,

"Time is your friend, impulse is your enemy. Take advantage of compound interest and don't be captivated by the siren song of the market."

Tags : ,

6, Sleti lane, Near Dera Satkartar,

Model Town road, opp. Ranbir

Gas Agency, Jalandhar city-144003

+91 9357253596

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes. We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments.

AMFI Registered Mutual Fund Distributor – ARN-44367 | Date of initial registration – 01-Oct-2023 | Current validity of ARN – 30-Sep-2026

Important Links | Disclaimer | Disclosure | Privacy Policy | SID/SAI/KIM | Code of Conduct | SEBI Circulars | AMFI Risk Factors